Property taxes, also referred to as an ad valorem tax, are taxes on the value of your real estate, such as your home. This type of tax is not collected by the federal government; rather, property tax is collected by states, counties, cities, and other local governments. Property tax rates vary not just across states but also within each state. The process of collecting property taxes can also vary, but the general process involves the assessment of the value of your home by a local government official and the computation of your property tax based on your area’s current property tax rate.

Fort Bend County Property Tax Rate

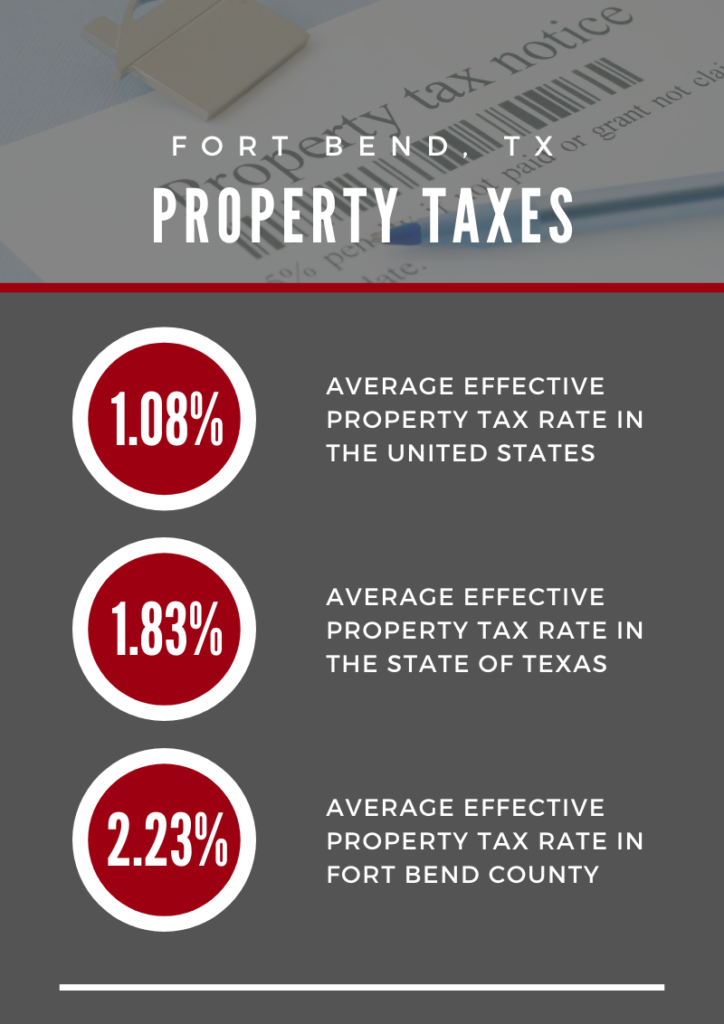

Overall, property taxes in the state of Texas are the sixth highest in the nation, with an average effective property tax rate of 1.83%. Compared to the national average of 1.08%, a typical Texas homeowner pays $2,775 annually in property taxes. Fort Bend County is the tenth largest county in Texas, but it has the highest average property tax payment in the Lone Star state. The average homeowner in Fort Bend pays $5,198 annually in property taxes, with an average effective tax rate of 2.23% which is more than double national average.

Last August, however, Fort Bend County Judge KP George announced that county residents would see a reduction in the 2020 property tax rates. The property tax rate was lowered to $0.424967 per $100 from last year’s rate of $0.4447 per $100. This is a significant improvement compared to the 2000 rate of $0.624 per $100.

Where Does the Revenue from Property Taxes Go?

There are two components for property tax revenues: the first one is debt service and the other one is operations and maintenance. Revenue from the debt service component is used to pay the annual debt service payments for the bonds that the district has issued since its inception. These bonds are issued to pay for infrastructure needed to provide water, sewer, and drainage to the residents. Revenue from the operations and maintenance component is allocated into the general operating fund to pay for general upkeep and repairs.

How to Compute Your Property Taxes

To determine your property tax bill, divide the value of your house by $100 then multiply the result by the current tax rate. The Fort Bend Central Appraisal District (CAD) is an independent government agency that determines the value of your home. The assessment is performed on the 1st of January 1 every year.

The Fort Bend Central Appraisal District mails an appraisal notice to homeowners every May. This notice specifies the value of your home as of January 1st of that year. If you do not agree with the value set by the Central Appraisal District, you have until May 31st to protest that value. Details and deadlines regarding the taxpayer protest process is also stated on the appraisal notice. If you have any concerns regarding the value of your property, you may contact your Central Appraisal District. The Fort Bend Central Appraisal District may be reached at 281-344-8623.

Homestead Exemption in Fort Bend County, Texas

Homestead Exemption removes part of your home’s appraised value from taxation. For instance, if your home is appraised at $100,000 and you qualify for a $20,000 exemption, your property tax is going to be computed by multiplying the current property tax rate by $80,000.

To qualify for this exemption, you must own and occupy your home as your principal residence since the 1st of January of the year for which you are requesting exemption. To apply, you will need to fill out the Application for Residential Homestead Exemption form, as well as provide a copy of your Texas Driver’s License or DPS Identification Card. The deadline for application is on the 30th of April. If you missed the deadline, you may still file your application up to one year after the date taxes became delinquent for the year (usually February 1st of the year following the tax year).

When are Property Taxes Due?

Tax statements are mailed starting October 1st and are due upon receipt.

What Happens If Property Taxes Are Not Paid?

If left unpaid, this becomes delinquent on February 1st of the following year, and penalties and interest will start accruing. If your property taxes remain unpaid until September, water service could be terminated at your home. In extreme cases, if you are unable to pay your taxes for more than a year, a lawsuit may be filed against you and your home could be sold for taxes. If your mortgage company is responsible for paying your property taxes from escrow, you, the homeowner, is still responsible for penalties and interest if they pay late or are unable to pay at all.

Can Property Taxes Be Paid in Advance?

Property taxes may be paid in advance by entering into a contract with the Tax Assessor Collector to escrow your taxes for the upcoming year. When tax bills are prepared, the Collector will apply the escrowed funds to your account and provide you with a receipt. If your escrowed funds are greater than the official amount of tax due, the Collector will send you a refund; if the escrowed funds are less than the tax due, the Collector will apply the escrowed funds, send you a receipt, and a tax statement for the additional amount due. The deadline for paying this amount is January 31st.

For more information about property taxes, you may go to the Fort Bend County Tax Assessor-Collector’s website.